FINTECH

PRODUCT & BRAND DESIGN

My Contribution

Product design

Design system

Brand Identity

Credit engine

The Team

1 x Product Designer

3 x Engineers

1 x Private Equity Professional

1 x Data Science Lead

Tribe is a financial technology platform aimed at easing access to working capital for small businesses in Ghana. The goal is to bridge the $9 billion small business lending gap and drive growth in industries dominated by micro and small businesses.

Many small businesses in Ghana struggle to access loans from existing financial services due to various obstacles, leading to a significant lending gap, so, Tribe aims to empower small businesses by offering accessible lending services and simplify the loan application process through advanced technology.

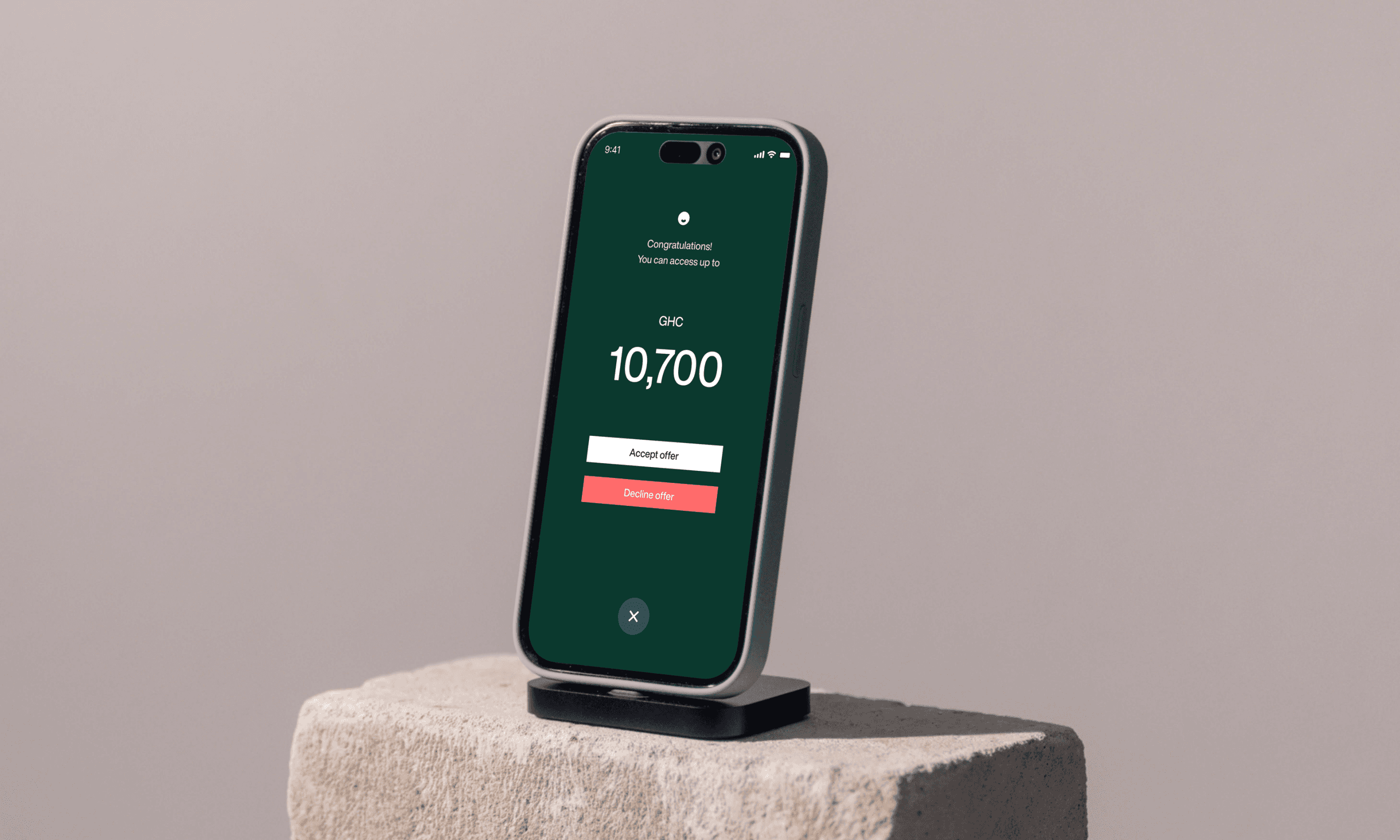

Tribe uses data science and open banking tools to create a fast and straightforward credit assessment engine. Small business owners can apply for loans, receive quick approvals within 24-48 hours, and access various financial products through a user-friendly mobile app. It also aims to enable businesses to repay conveniently through a simple payment infrastructure.

Chancing on the challenge

As the founding designer of Tribe, I encountered the pressing issue of limited access to capital for small businesses during my time as a Graduate Intern in a retail bank. Being an insider and actively contributing to the credit assessment process, I gained a unique perspective that highlighted the bias towards medium-sized and large businesses in the system. Additionally, I observed that microfinance institutions, while an alternative, charged exorbitant interest rates, largely due to their extensive physical networks.

Recognizing the significance of this challenge, I saw an opportunity to develop a simple yet effective solution for this underserved space, which ultimately led to the creation of Tribe.

Talking to users

As much as it’s obvious that small businesses need a better way to access capital, we wanted to know what the right product looked like for these small business owners. We were able to speak to different groups from the Ghana Enterprises Agency (formerly NBSSI) and here are some of our findings:

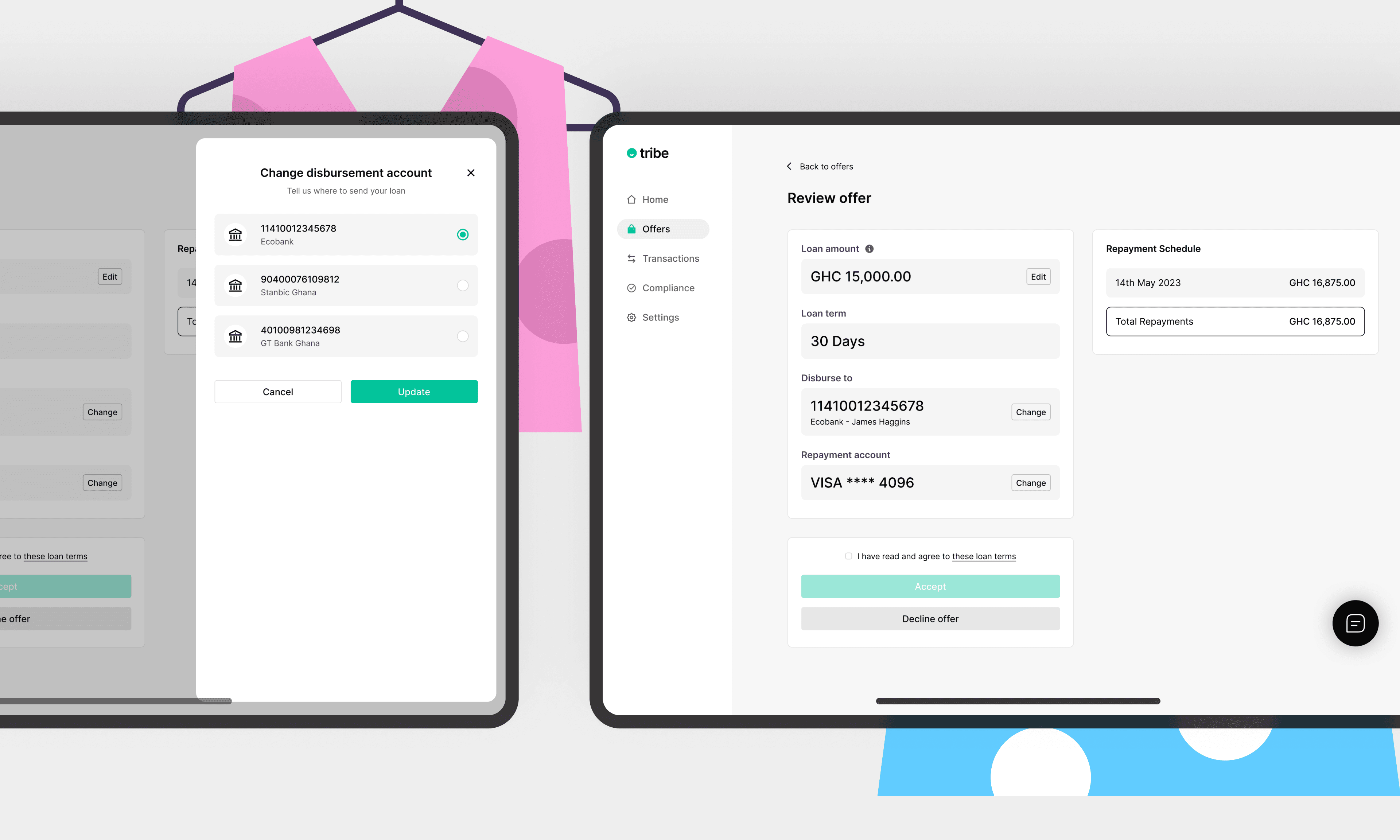

Fee transparency is a big deal!

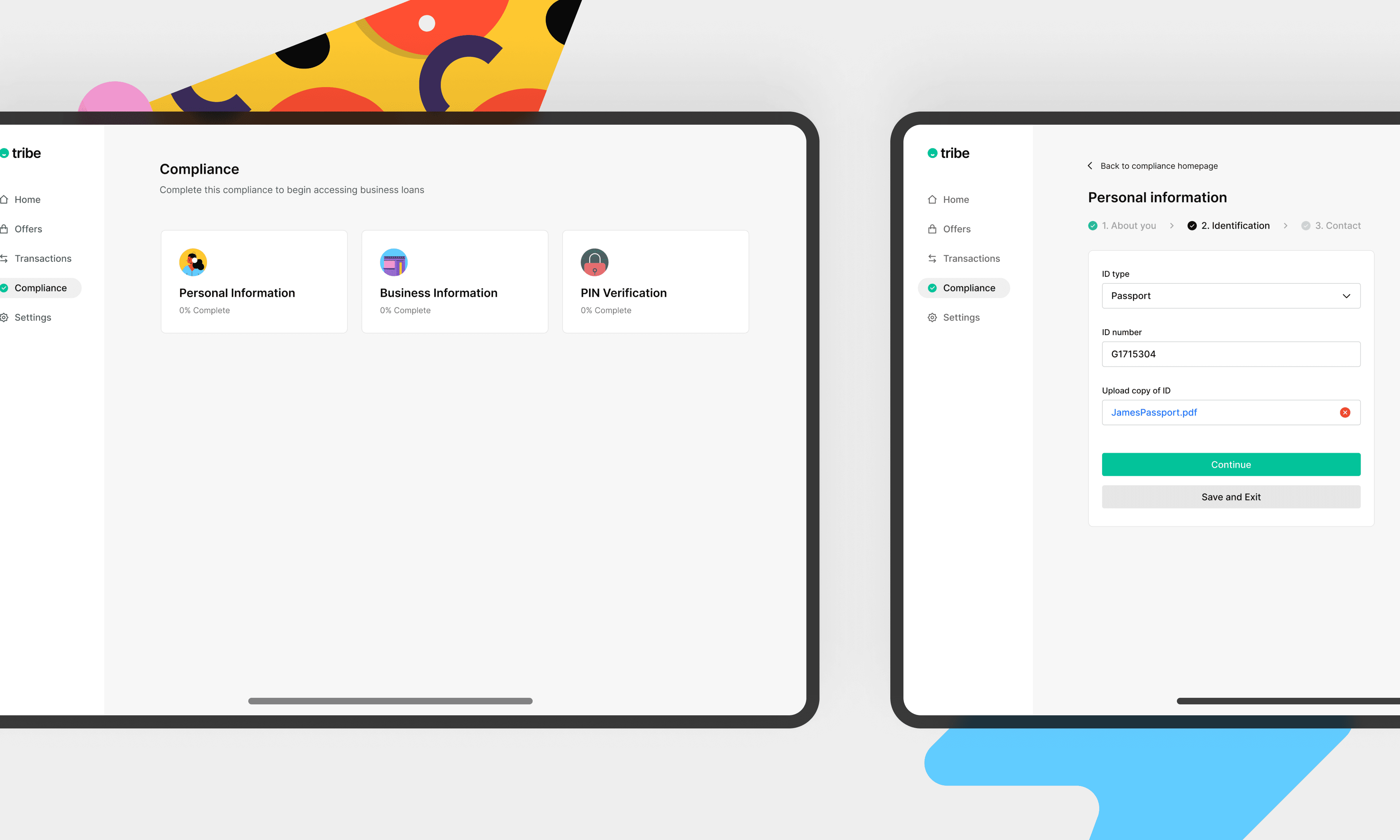

Before using the core product (loan application in our case) many digital products require too much information in the onboarding stage, which causes some users to abandon the process.

It helps to include tips and guides at every point in the product.

Engineering constraints

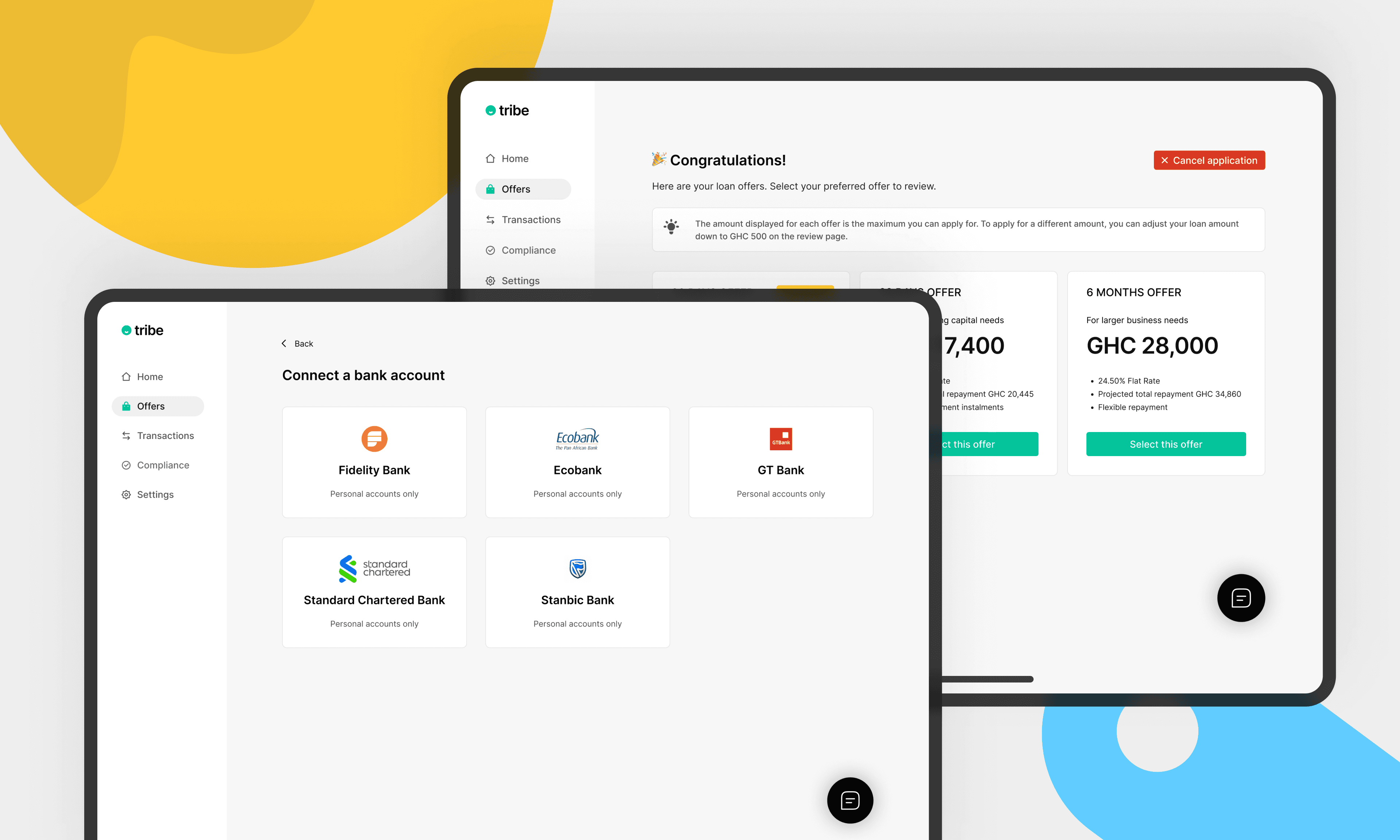

Since our lending is cashflow-based, it is important for us to obtain credible historical financial information from our users. However, during the initial development of the product, open banking tools were unavailable in Ghana. As a result, we devised a solution that could process bank statements, analyze the data, and provide users with loan recommendations.

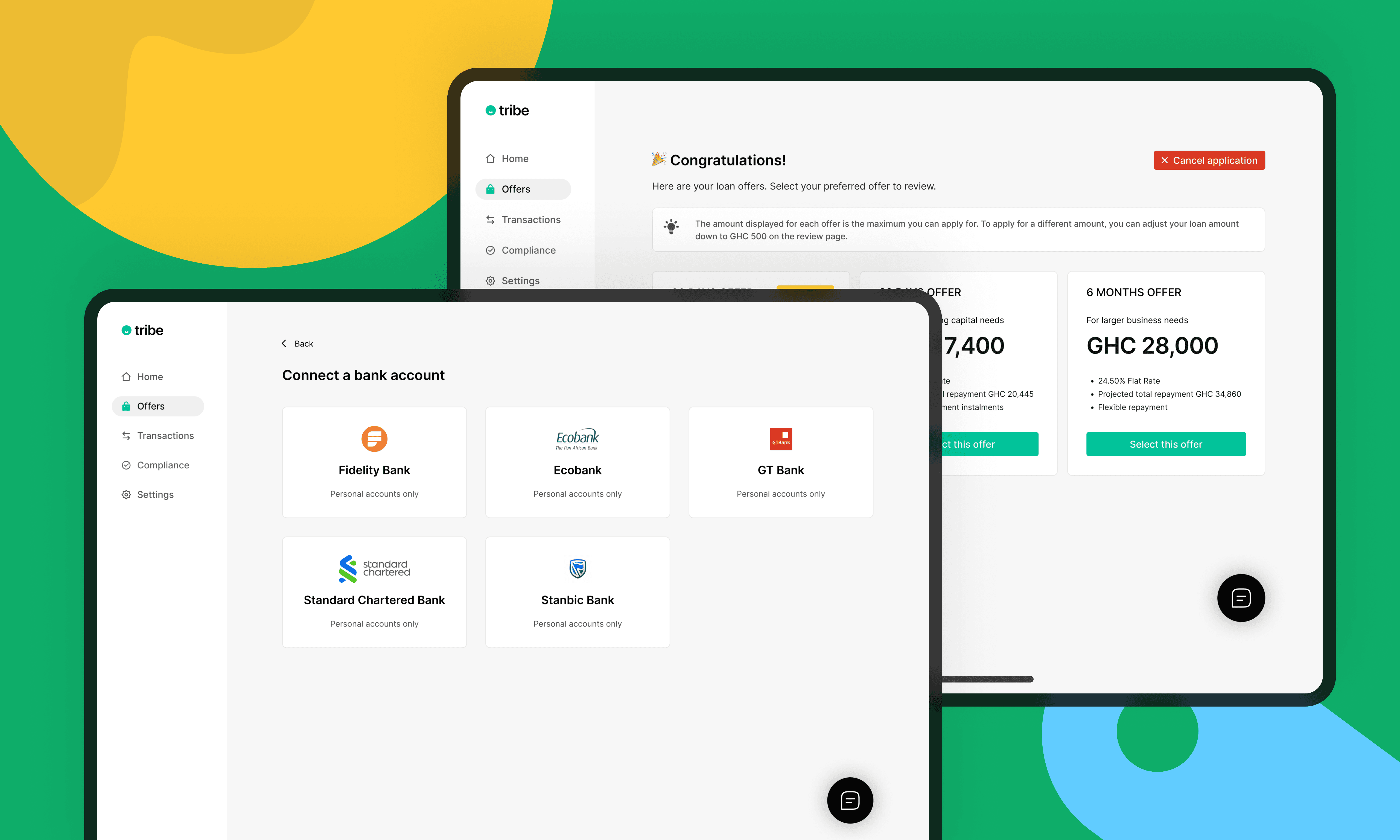

To achieve this, I personally developed a bank statement parser using Natural Language Processing (NLP) technology, which was seamlessly integrated into the product. We have since gone on to build an internal open banking tool named Knot which currently allows us to connect with six local banks.

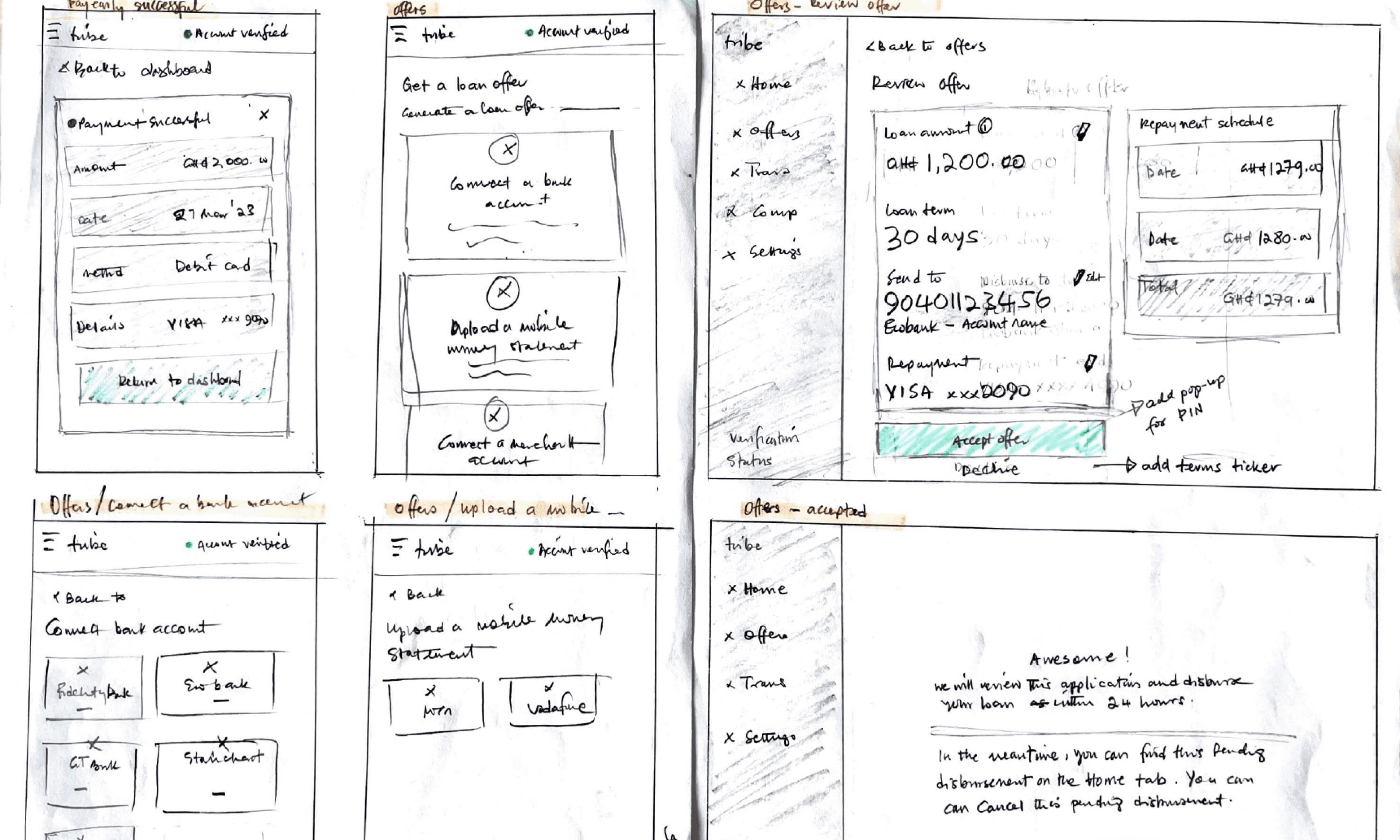

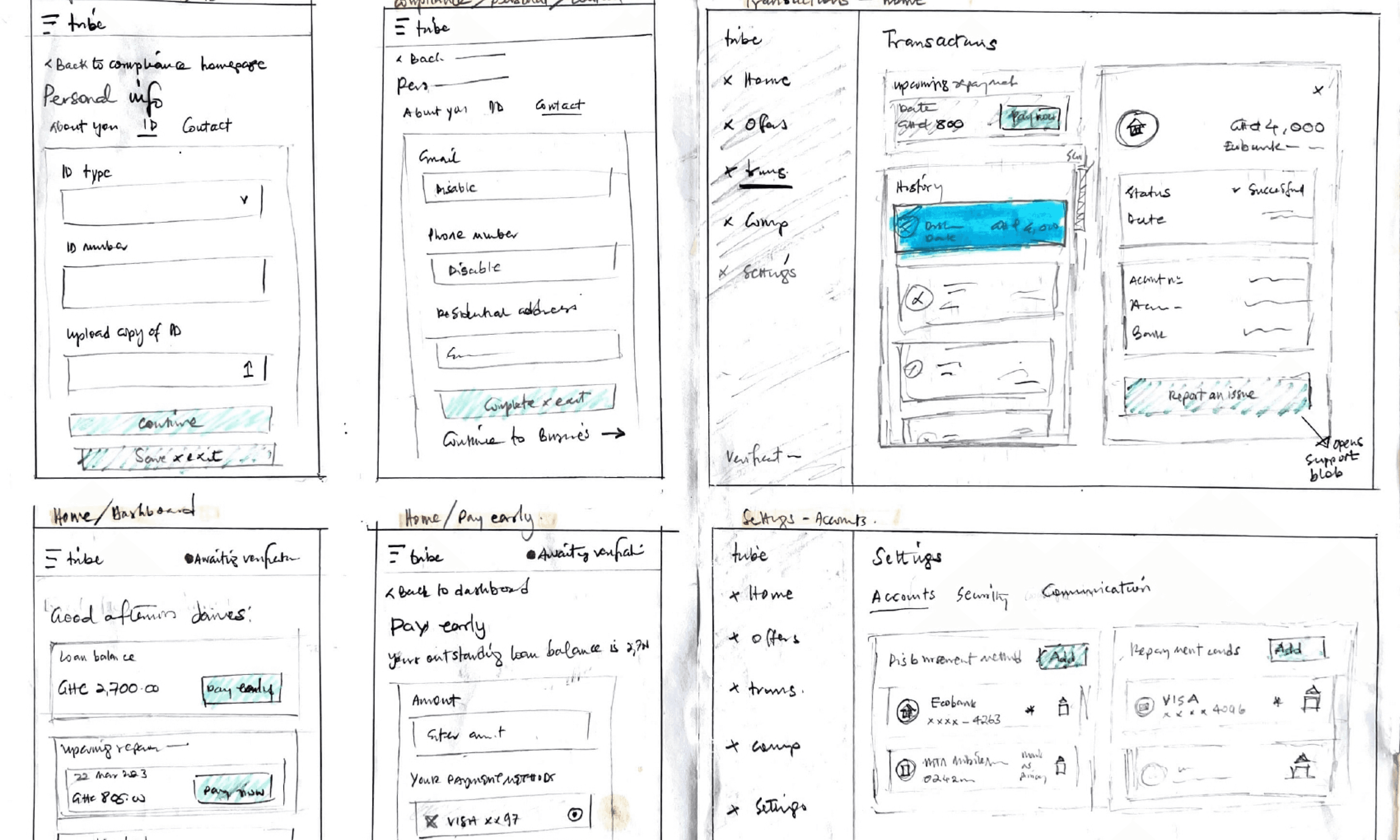

Design-Test-Repeat

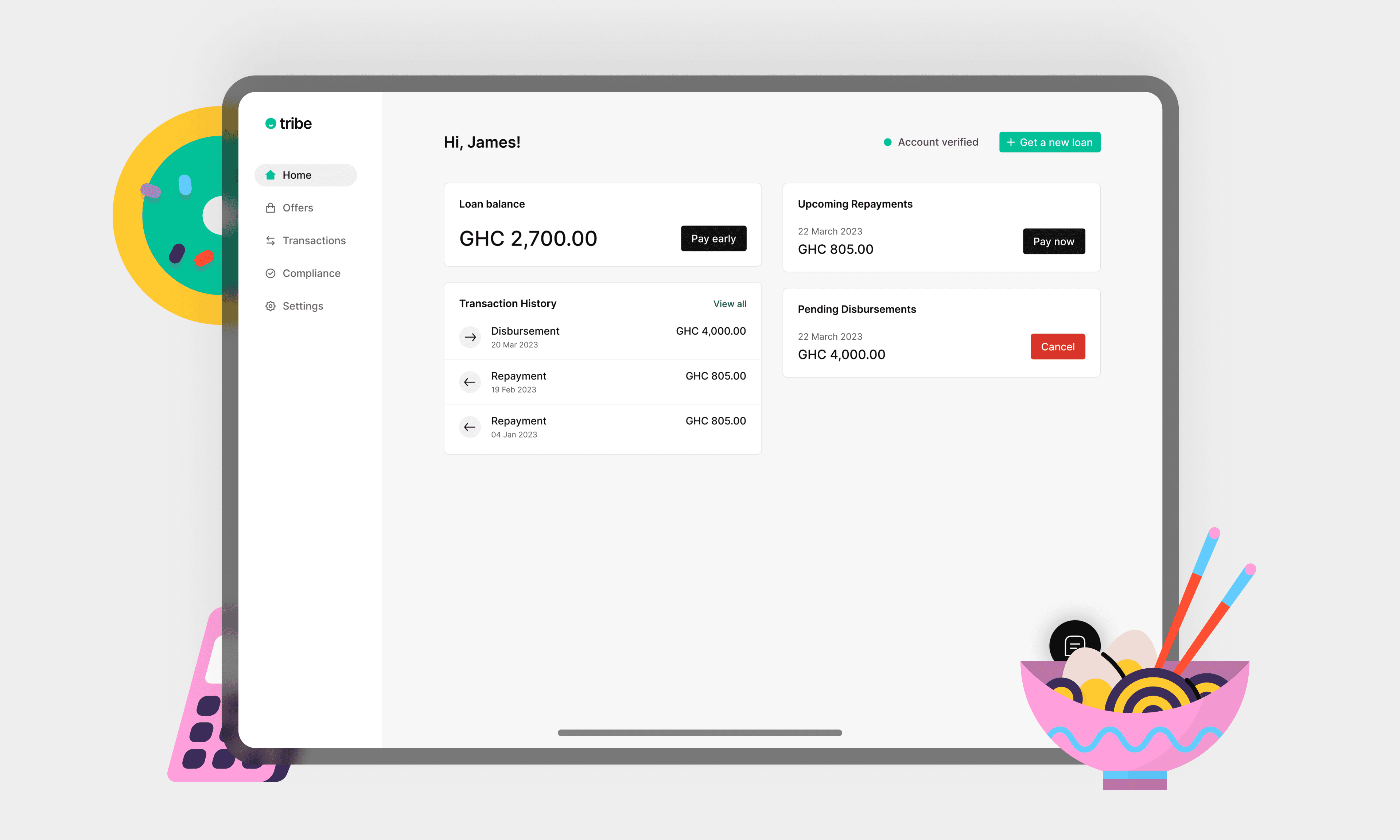

In pursuit of simplicity and speed for the user, we went through multiple iterations. The most impactful tests were the product demos conducted with small business owners from our waitlist. These valuable insights influenced various aspects of the design, particularly the onboarding/sign-up process. For instance, we refined the process by deferring the requirement for disbursement bank accounts and repayment method information until after the first loan application is completed, rather than during the initial sign-up stage.

The Tribe web app MVP took us about 9 months to finish partly because all the team members worked part-time on the product. The web app is currently available in closed beta to over 50 small business owners from our waitlist. We've also been able to lend a total of about $30,000 and seen a repayment rate above 95%. Tribe is still not available to all small businesses because we are awaiting regulatory approval from the central bank.